Loan Delinquency Analysis Report Template

- Financial Services

- Operations

Industry

Function

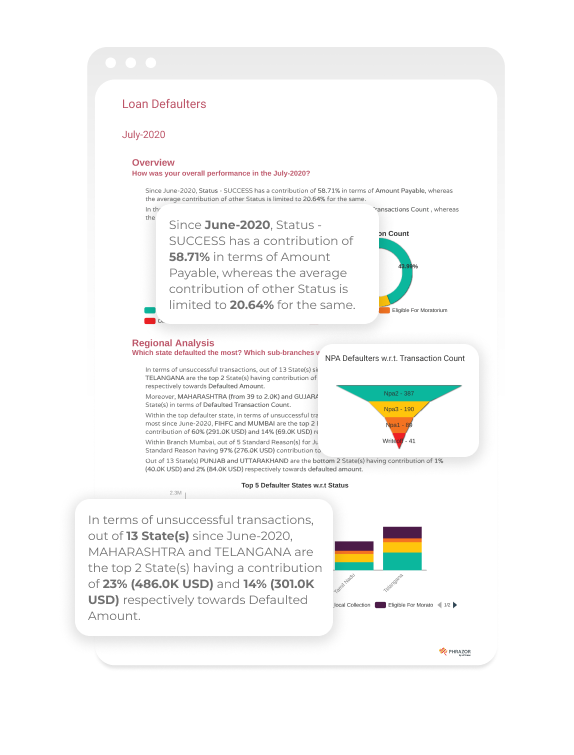

This template will help you extract and analyze loan defaulter information of your bank based on the input data and present comprehensive insights about the trends and causes of the defaulted amount. It analyzes the loan amount and transaction count to determine the regions, payment modes and products that lead to the most defaulted amount. Using visual dashboards and narrative language, it also provides information about the customers with the most defaulters, along with the common reasons causing the default.

The outcome of the template is designed to help banks to trace out loan defaulters with the reasons for the defaults, and help them take necessary steps to carry out loan recovery.

It answers questions such as:

- What is the overall success and failure trend for a particular period in terms of loan amount and transaction count?

- Which regions and sub-branches are most responsible for defaulters?

- Which are the top regions with the most defaulters?

- What payment modes experience the most defaulted amount?

- Which regions mainly use the payment modes causing the most default?

- Which are the top products having the most contribution towards the default amount?

- Which products have the least contribution towards the default amount?

- Which customers have the most number of defaults?

- What are the common reasons causing defaults?

To use this template, simply download it, connect/upload your data to the dashboard, and run the report, all in just a few clicks.