INDUSTRY: BANKING AND FINANCE

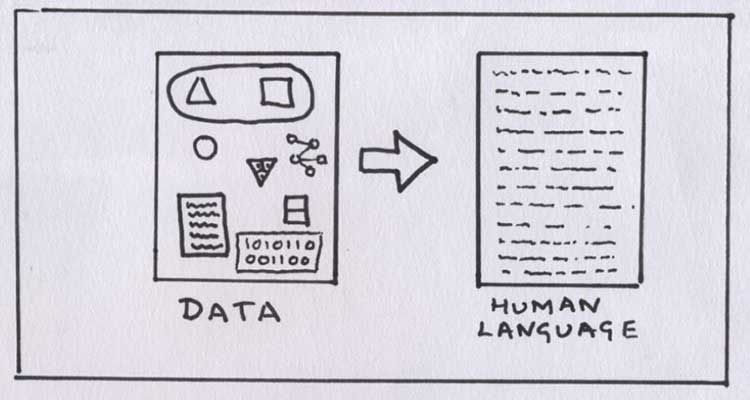

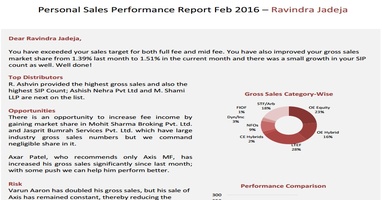

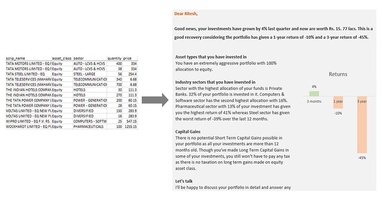

Reporting Automation for Financial Services Companies

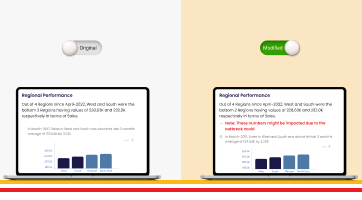

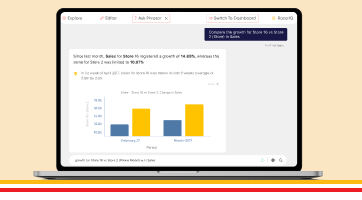

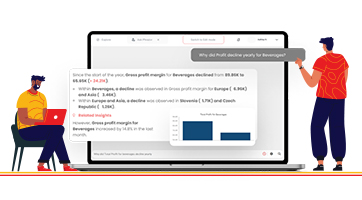

Win back hours in your day by regulating labor-intensive processes with intelligent automation. Deliver a consistent, objective view of the performance drivers of your data in a scalable fashion using Natural Language Generation.

Request a DemoOr try our new product Explorazor made specially for consumer goods companies

.jpg)

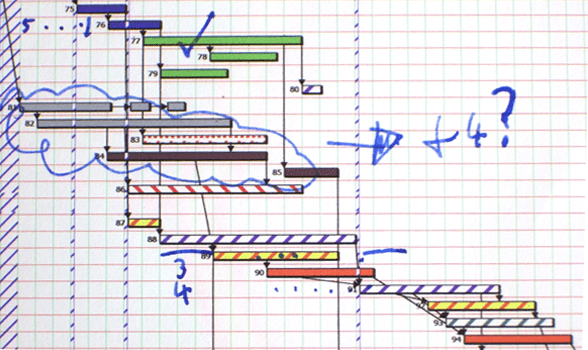

Performance Analysis Report Template.png)

Performance Report Template.png)

Performance Report Template.png)

Goal Conversion Report Template.png)

Performance Report.jpg)